Sustainable Finance Regulation

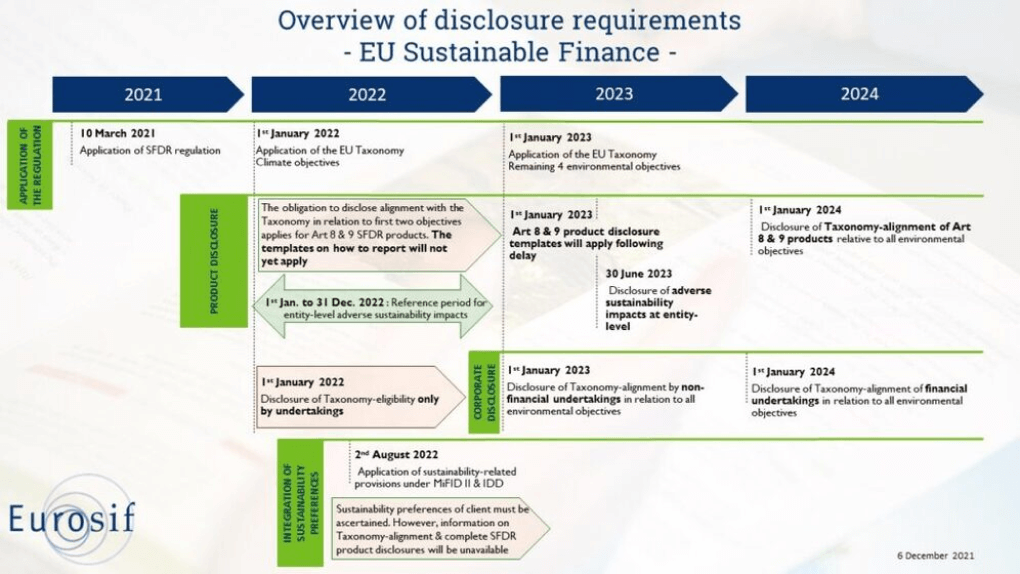

The growing influence of investors, society, and environmental concerns has led to a proliferation of sustainable finance regulations affecting various actors in the financial industry, from corporations to fund managers.

The implementation of robust regulations in sustainable finance provides several benefits. It enables market participants to navigate the investment landscape with greater confidence and clarity, as well as promotes consistency and standardization across the market. These ensure that relevant information and disclosures are readily available, empowering investors to actively choose sustainable investments and contribute to the development of a more sustainable economy.

Regulatory efforts have been implemented in the context of the Paris Agreement and the urgent need to mitigate the impacts of climate to align financial activities with sustainability goals, promote responsible investment practices, and facilitate the transition to a low-carbon economy.

Sustainable finance regulations provide a framework for financial institutions, such as banks, asset managers, and insurance companies, to incorporate sustainability considerations into their operations and investment strategies. They take various forms including laws, directives, guidelines, and reporting requirements.